The Complete Guide to Outsourcing Fintech Software Development

Fintech Software Development Outsourcing is the process of hiring an outside company to design, develop, and maintain financial technology solutions. It is not just about outsourcing programming tasks but also includes a wide range of services, from strategic consulting to ongoing maintenance. According to Grand View Research, the global IT outsourcing market is expected to reach $397.6 billion by 2025, reflecting businesses’ increasing reliance on outside expertise for complex technology solutions.

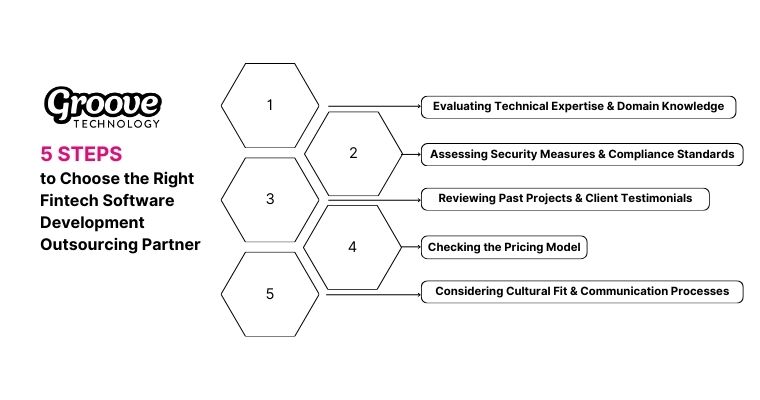

This article provides a comprehensive guide to choosing the right Fintech software development outsourcing partner. It covers important factors to consider, including assessing technical expertise, security measures, past projects, pricing models, and cultural fit.

According to a PWC report, 20% of fintech organizations are currently outsourcing, and 65% plan to incorporate outsourcing solutions into their future business plans. This shows the growing importance of outsourcing in the fintech industry.

The article also discusses the benefits, challenges, and suitable target audience for fintech software development outsourcing. Finally, it introduces Groove Technology as a professional service provider in this field.

What is Fintech Software Development Outsourcing?

Fintech software development outsourcing involves hiring an external company to design, develop, and maintain financial technology solutions. It's not merely about delegating coding tasks; it encompasses a range of services from strategic consulting and UX/UI design to backend and frontend development, testing, deployment, and ongoing maintenance.

According to Grand View Research, the global IT outsourcing market is expected to reach $397.6 billion by 2025. This trend reflects businesses' growing reliance on external expertise for complex technological solutions.

An ideal outsourcing partner becomes an extension of your internal team, bringing technical skills and deep industry insights. You will receive today's most advanced technology solutions from your outsourcing experts.

How to Choose the Right Fintech Software Development Outsourcing Partner

Selecting an ideal outsourcing partner is crucial for fintech software development success. When evaluating potential partners, prioritize these key factors:

- Technical Expertise and Domain Knowledge: Proficiency in fintech-specific languages (Python, Java, C++)

- Security Measures and Compliance Standards: Robust security protocols (ISO 27001 or SOC 2 certifications), strict adherence to regulations (GDPR, PSD2, AML)

- Past Projects and Client Testimonials

- Pricing Model

- Cultural Fit and Communication Processes

By focusing on these criteria, you can identify a partner equipped to advance your fintech initiatives with the necessary skills, knowledge, and reliability. The following sections explore each factor in more detail to guide your decision-making process.

Evaluating Technical Expertise and Domain Knowledge

When assessing potential partners, verifying their proficiency in fintech-specific technologies and understanding of the financial industry is essential. Look for expertise in relevant programming languages such as Python, Java, or C++ and experience with fintech-specific frameworks and tools. A track record of successful fintech projects and a deep understanding of financial regulations and compliance requirements are also crucial.

Ensure your chosen partner can effectively fill these capability gaps, bringing the specialized skills and knowledge to advance your fintech projects.

Assessing Security Measures and Compliance Standards

In the fintech industry, security and compliance are paramount. Your outsourcing partner should demonstrate robust data protection protocols and strict adherence to financial industry regulations such as GDPR, PSD2, and AML. Look for relevant security certifications like ISO 27001 or SOC 2, which indicate a commitment to maintaining high-security standards.

Reviewing Past Projects and Client Testimonials

Examining the potential partner's portfolio and seeking client feedback can provide valuable insights into their capabilities and reliability. You should pay close attention to the relevance and quality of their previous fintech projects, as this can indicate their ability to handle your specific needs.

In addition, testimonials from past fintech clients can offer real-world perspectives on the partner's performance, communication style, and ability to deliver results. Additionally, consider the partner's industry reputation and any awards or recognitions they've received, as these can be indicators of their standing in the fintech community.

Checking the Pricing Model

Comparing pricing models is essential to ensure they align with your budget and project requirements. Common models include fixed-price contracts, time and materials pricing, and dedicated team models. Each has advantages and potential drawbacks, so consider which best suits your project's needs and your company's financial structure.

According to a report by Statista, cost reduction remains one of the top reasons for IT outsourcing, with 35% of companies citing it as a primary factor. However, it's crucial to balance cost-effectiveness with quality. The cheapest option is only sometimes the best, especially in the complex and regulated world of fintech. Look for a partner that offers transparent pricing and can demonstrate the value they bring to your project.

Considering Cultural Fit and Communication Processes

Effective collaboration is crucial for project success, making cultural fit and communication processes important considerations. Evaluate the potential partner's communication channels and protocols to ensure they align with your preferred working style. English proficiency is crucial for clear communication, especially for complex fintech projects.

Time zone compatibility is another factor to consider, as it can impact real-time collaboration and response times. Lastly, assess whether the partner's work culture aligns with your company's values and expectations. A good cultural fit can lead to smoother collaboration, a better understanding of project goals, and, ultimately, a more successful outsourcing partnership.

5 Key Benefits of Software Development Outsourcing in Fintech

Cost Savings and Resource Optimization

Outsourcing software development can significantly reduce costs for fintech companies. A 2023 Deloitte study found that outsourcing can cut development expenses by 20-30% compared to in-house teams. This approach eliminates costs related to hiring, salaries, benefits, training, and infrastructure maintenance.

Access to Specialized Expertise and Technologies

Outsourcing partners often provide diverse teams with specialized skills. A 2024 McKinsey report revealed that 71% of fintech executives cite access to specialized skills as a primary reason for outsourcing, a trend that is equally applicable when companies outsource eLearning software development to gain expertise in specific educational technologies. This allows companies to leverage a broader range of expertise than they could maintain internally. Additionally, Gartner's 2024 research showed that fintech companies partnering with outsourcing firms were 2.5 times more likely to implement emerging technologies like AI and blockchain.

Faster Time-to-Market and Improved Scalability

Dedicated outsourced teams can accelerate project progress. Accenture's 2023 research demonstrated that fintech companies using outsourcing reduced their product development cycles by an average of 40%. Outsourcing partners often have established processes and can quickly adjust resources based on project needs. A 2023 KPMG study found that 68% of fintech startups reported improved scalability after outsourcing software development.

Focus on Core Business Functions

By delegating software development to experts, internal teams can concentrate on core business strategies and operations. A 2024 Ernst & Young survey revealed that 57% of fintech companies outsource software development to allow their in-house teams to focus on core business processes. This strategic shift can lead to improved overall business performance.

Risk Mitigation and Global Expansion

Outsourcing can help manage risks, particularly in cybersecurity and regulatory compliance. A 2023 PwC report showed that 62% of fintech companies cited risk mitigation as a key benefit of outsourcing. Moreover, a 2024 Boston Consulting Group study found that fintech companies that outsource software development are 30% more likely to successfully expand into new international markets

4 Major Challenges in Fintech Software Development Outsourcing

While outsourcing offers benefits, fintech companies face significant hurdles:

Data Security and Privacy Risks

Handling sensitive financial data demands robust security. A 2023 Deloitte study found 65% of financial services firms cite cybersecurity as their top outsourcing concern. Ensure partners have strong security protocols and comply with data protection regulations.

Regulatory Compliance Complexity

The heavily regulated fintech industry requires outsourcing partners well-versed in relevant laws. Gartner research (2024) reveals 72% of fintech companies struggle with regulatory compliance when outsourcing, especially around data protection laws like GDPR.

Communication and Cultural Barriers

Time zones, language differences, and work culture variations can cause misunderstandings. McKinsey's 2023 report showed 58% of fintech startups faced 3+ month project delays due to communication issues with offshore teams. Clear protocols and cultural awareness are crucial.

Quality Control and Specialized Skill Gaps

Maintaining consistent quality with remote teams is challenging. Accenture (2023) found fintech companies lose an average of $3.7 million yearly due to poor quality control in outsourced projects. Additionally, Capgemini's 2024 survey revealed 41% of fintech firms struggle to find partners with specialized skills in areas like blockchain and AI.

Who is Fintech Software Development Outsourcing Suitable For?

Fintech software development outsourcing can benefit a wide range of organizations, including:

- Startups: For Fintech startups, outsourcing can provide access to experienced developers without the overhead of a full in-house team.

- Established Financial Companies: Traditional financial institutions looking to modernize their offerings can leverage outsourcing to quickly develop and deploy new Fintech solutions.

- Fintech Companies: Even established Fintech companies can benefit from outsourcing specific projects or augmenting their in-house teams during peak periods.

- Financial Service Providers: Companies offering financial services as part of their broader business can use outsourcing to develop specialized Fintech tools.

- Non-Financial Companies Entering Fintech: Companies from other sectors looking to offer financial services can use outsourcing to quickly build the necessary technological capabilities.

Groove Technology – A Professional Provider of Fintech Software Development Outsourcing

Groove Technology offers compelling reasons to consider them for fintech software development outsourcing:

- Proven Track Record: Over 120 successful projects and 97% customer retention rate demonstrate consistent high-quality service delivery.

- Global Expertise: Serving clients across Australia, UK, Europe, and Asia Pacific, bringing international experience to fintech projects.

- Comprehensive Services: Offering a wide range of solutions including e-commerce, data analytics, and CRM systems tailored to diverse industry needs.

- Seamless Integration: Adapts to any development framework (Agile, Scrum, Kanban) for smooth alignment with existing processes.

- Proactive Communication: Engineers actively listen and clarify questions to bridge expectation gaps.

- Transparent Pricing: Detailed cost breakdowns and performance incentives provide clear investment understanding, with upfront finalization and scaling flexibility.

- Quality Assurance:

- Certified developers selected through rigorous recruitment

- Emphasis on both technical skills and positive attitude

- Ongoing training to maintain and enhance resource quality

- Long-Term Partnership Focus: Commitment to sustained relationships drives continuous improvement initiatives.

Groove Technology combines technical expertise, global experience, and client-centric practices to deliver high-quality fintech solutions. Their transparent approach and focus on long-term partnerships make them a strong contender for companies seeking reliable software development outsourcing.

FAQs

What is the average cost of outsourcing fintech software development?

The cost of outsourcing fintech software development can vary widely depending on project complexity, team size, and geographical location. On average, rates can range from $25 to $150 per hour, with Eastern European and Asian countries often offering more competitive rates compared to Western countries.

How long does a typical fintech software development project take?

Project duration depends on the scope and complexity of the software. Simple applications take 3-6 months, while complex, enterprise-level systems require 12-18 months or more. Agile methodologies can deliver initial versions faster, with continuous improvements over time.

Can outsourcing help with regulatory compliance in fintech?

Yes, many outsourcing providers specialize in fintech and have extensive knowledge of regulatory requirements. They can help ensure your software complies with relevant regulations such as GDPR, PSD2, and AML. However, choosing a partner with a strong track record in regulatory compliance is crucial.

What are the skills most in demand for fintech software development?

Key skills in fintech development include:

- Blockchain technology

- Artificial Intelligence and Machine Learning

- Cybersecurity

- Cloud computing

- API development and integration

- Data Analytics

A survey by the Financial Stability Board found that these technologies are among the most widely adopted in the fintech sector.

Conclusion

Selecting the right Fintech software development outsourcing partner is crucial for your business success. By evaluating potential partners based on their technical expertise, security measures, past performance, pricing, and cultural fit, you can find a partner that supports your current needs and long-term growth in the dynamic Fintech landscape.

At Groove Technology, we aim to be more than a service provider – we strive to be a true partner in your Fintech journey. We're ready to help you navigate the complexities of Fintech development, stay ahead of technological trends, and deliver innovative solutions that drive your business forward.