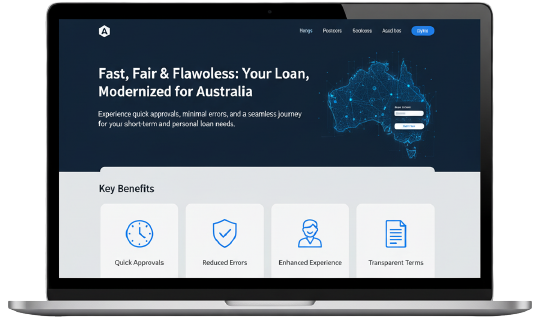

Loan Origination System for a Consumer Finance Company

Challenges

A consumer finance company in Australia wanted to digitize its manual loan application process. Their legacy system relied heavily on spreadsheets and email-based document exchange, creating slow approvals and compliance risks. They needed:

- A secure, automated loan origination platform.

- Smooth integration with credit bureaus and e-signature providers.

- A scalable architecture supporting both staff and customer portals.